I've been reading the "Beyond Scarcity" series on FTAlphaville recently, and it's made some very interesting points. The posts argue that the current economic environment is deflationary with regard to goods. I think that is true, and one of the reasons is because of technology. Firstly technology is constantly making everything more efficient and because of global competition this is both reducing the production costs and making goods cheaper. Secondly technology is causing structural unemployment, which means less people have money to spend and there is less money flowing around the economy. Other factors causing deflation are the tight monetary conditions, the aging population, and potentially the effects of quantitative easing.

Estimating correlation with missing data

Evaluating Bio-Techs

Clinton Chee has posted a list of factors he thinks is important when analyzing Bio-Tech stocks. This list is summarized below:

How the Market Cap of Financial Firms has changed

The New York Times has a great interactive graphic on How the Giants of Finance Shrunk, then Grew, Under the Financial Crisis. It's really interesting seeing how, if the Market Capitalization of each firm is represented as an area, the each firm shrinks massively during the financial crisis, and now how the firms are rebounding.

Financial models need more complexity?

A post over at the New York Times is arguing that one of the main causes of the financial crisis was inadequate quantitative models - models that tended to understate risk because they failed to provide a realistic model of the way the world works - neither incorporating risks such as a failure of liquidity, nor the complexities of human behaviour.

I certainly agree that the current stable of models which are in widespread use are inadequate given that the competitive market has made the spreads on trades so tight that there is no longer any buffer to cover the many short-falls in the models. Back when vanilla options were an exotic trade, the trader would incorporate plenty of fat in their options trades. Intense competition, a market that has steadily grown over the past 20 years (notwithstanding small glitches), and increased familiarity with the trades has served to camouflage the risks the traders were running in their options books.

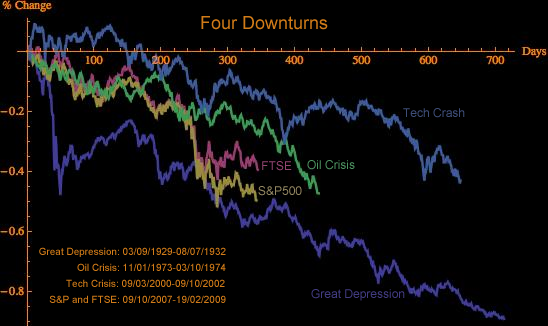

Comparison of Downturns

A while ago, I created a Mathematica plot comparing the Great Depression, the Tech Crash and the Oil Crisis with the current financial crisis. This analysis was inspired by a chart I saw last year comparing these recessions with our current situation. Anyway, I thought it was worth bringing the chart up-to-date.

[Edit] The original chart I saw was this one.[/Edit]

[caption id="attachment_166" align="alignnone" width="548" caption="Comparison of four economic downturns"] [/caption]

[/caption]

Lehman Brothers

Papers on the "Credit Crunch"

- Leveraged Losses: Lessons from the Mortgage Market MeltdownThis paper provides a good overview of the financial market turmoil occurring since August 2007, and discusses how the crisis might impact other areas of the economy.

- A Black Swan in the Money Market This paper examines the sudden jump in spreads between the overnight and term inter-bank interest rates.

More Financial Blogs

- The Aleph Blog - Investment strategies and advice (seems pretty US-centric)

- The Epicurean Deal Maker - Sarchastic, sardonic and humerous insight into Wall Street

- Going Private - The Sardonic Memoirs of a Private Equity Professional - This is an absolutely hilarious blog about the world of Private Equity. Excellent!

- A Fist-full of Euros - An interesting blog focusing on European finance/economics/politics.