There is an interesting post over at pieria.co.uk called "The Financialisation of Labour". Frances Coppola compares the changing economic incentives between a company making a capital investment in a slave and an employee. She then suggests replacing the word "slave" with the word "robot".

Developers as Capital

I've just been reading this Forbes article called "The Rise of Developeronomics". The author argues that because increasingly software is the core value proposition that differentiates companies from each other, that software developers are more and more becoming the wealth creators in society. The author recommends investing in software developers as a way of leveraging your own capital. This article builds on an earlier article by David Kirpatick called "Now Every Company is a Software Company".

The Weirdness of Equity Markets

Equity markets constantly surprise me. It's looking increasingly likely that the Eurozone will disintegrate - leading to potential bank failures, stagnant economic growth and increased unemployment - and the equity markets here in Europe are pretty much shrugging it off today. The FTSE100 is up over half-a-percent at pixel time.

Were the Luddites Right?

The Luddites were a 19th century anti-industrialisation movement (and militia), who believed that their jobs were at risk because of the industrialisation of manufacturing. They proceeded to try and destroy mechanical looms in a vain attempt to turn back the rising tide of industrialisation. These days anyone seen as a "Luddite" is perceived to be backward and anti-technology.

Race Against The Machine

I just finished reading the Kindle book Race Against The Machine, a book I thoroughly recommend. This was the driver of the NPR article I blogged about recently. The book is mostly oriented towards the US, although the issues they discuss seem to be prevalent across all major economies. The authors make the case that technological improvements are severely impacting every job market except those for highly-skilled individuals.

How the Market Cap of Financial Firms has changed

The New York Times has a great interactive graphic on How the Giants of Finance Shrunk, then Grew, Under the Financial Crisis. It's really interesting seeing how, if the Market Capitalization of each firm is represented as an area, the each firm shrinks massively during the financial crisis, and now how the firms are rebounding.

Detroit - Ground Zero for Economic Collapse

Here is a video showing how badly Detroit has been affected by the collapsing housing market. Towards the end of the video you can see some amazing mansions in the worst-hit areas of Detroit that you can supposedly buy at a massive discount.

Social Collapse - Best Practices

Hmmm.... first I read this transcript from a speech by Dmitry Orlov entitled "Social Collapse - Best Practices", and then I saw on Boing Boing the post How are you coping with Collapse-Anxiety?

The first post describes what might happen if the US collapses in the same way economically as the USSR did in the 1990's. It then goes on to making recommendations about what to focus on - essentially food, transportation, shelter and security. I thought it was fascinating because although I have been thinking for a number of years that the economic situation was going to get bad, I didn't envision quite a collapse of that order of magnitude. As the crisis continues however, the possibility suddenly seems to become credible.

I found the comments interesting in the Boing Boing post. It seems as though quite a number of people were actually starting to find themselves in situations reminiscent of those described in the first post - primarily from posters in the US. Scary.

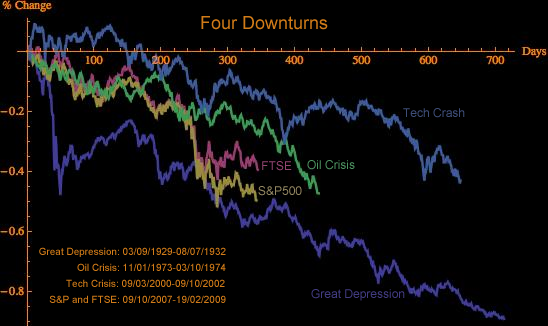

Comparison of Downturns

A while ago, I created a Mathematica plot comparing the Great Depression, the Tech Crash and the Oil Crisis with the current financial crisis. This analysis was inspired by a chart I saw last year comparing these recessions with our current situation. Anyway, I thought it was worth bringing the chart up-to-date.

[Edit] The original chart I saw was this one.[/Edit]

[caption id="attachment_166" align="alignnone" width="548" caption="Comparison of four economic downturns"] [/caption]

[/caption]